MSME/Udyam Aadhar Registration

——————————————————

Price: ₹ 550/-*

*Subject to approval of Government portal services

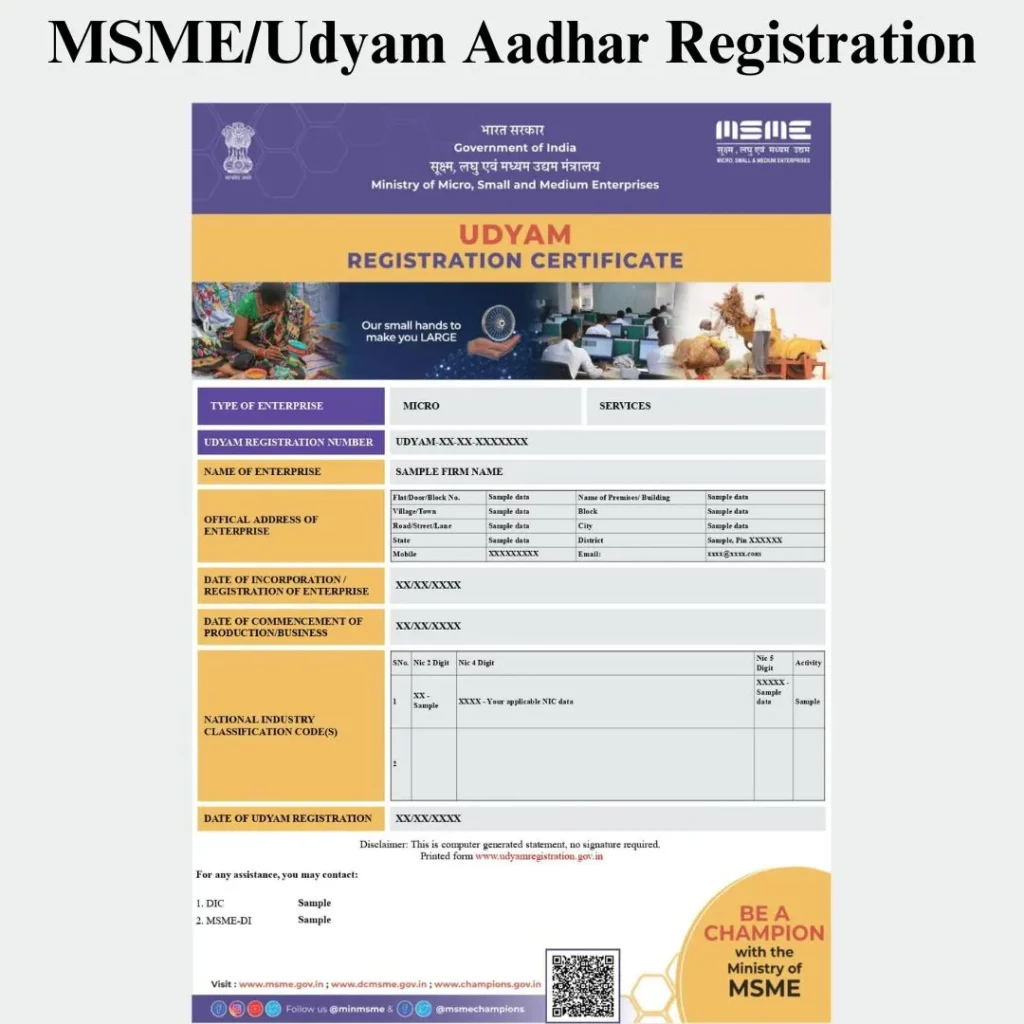

1) MSME Registration (UDYAM) Certificate

MSME/Udyam Registration in Pune

MSME (Micro, Small, and Medium Enterprises) registration is a government initiative in many countries that offers various benefits and assistance to small and medium-sized businesses. The MSME registration process in India is also referred to as Udyam Registration. MSME Registration in India is given to micro, small, and medium-sized businesses in accordance with the MSME Act, 2006.

Every type of business in India, including Private Limited Companies, Limited Liability Partnerships (LLP), sole proprietorships, partnership firms, and One Person Companies (OPCs), is eligible to apply for and receive UDYAM Registration. The registration does not need to be renewed. MSME registration is full online process and aadhar based process.

Udyam Registration, or MSME Registration in Pune is a single, fully digital, and paperless process. Holders of an MSME certificate may benefit from various initiatives introduced by the Ministry of MSME.

Only the Adhaar number will be required for registration. No enterprise may file more than one Udyam Registration. However, any number of activities, including manufacturing, service, or both, can be specified or added to a single registration. Enterprises can modify Udyam Registration as needed. Modifications include business address, income tax information, classification, and so on.

When an enterprise ceases to conduct business or closes its business, it may apply for the surrender of its MSME certificate through its director or another person.

CRITERIA FOR MSME REGISTRATION

The following criteria will determine whether an organisation is a micro, small, or medium enterprise: —

✑ A microbusiness with a maximum investment in plant, machinery, or equipment of Rs. 1 crore and a maximum annual revenue of Rs. 5 crore;

✑ A small business with a turnover of no more than fifty crore rupees and an investment in plant, machinery, or equipment of no more than ten crore rupees; and

✑ A medium-sized business, defined as one with a turnover of no more than 250 billion rupees and an investment in plant, machinery, or equipment of no more than 50 crore rupees.

MSME Registration Process in Pune

✑ Fill in the Udyam Registration Form: Fill out the online registration form with your name, Aadhaar number, business details, PAN card number, and other relevant information.

✑ Verification and Submission: Verify the information provided and submit the application. The system will create an acknowledgment number for future reference.

✑ Obtain Udyam Certificate: You will receive the Udyam Registration Certificate once your registration has been processed and approved. This certificate is required to access benefits and schemes for MSMEs.

ADVANTAGES OF MSME REGISTRATION

Micro, Small, and Medium Enterprises (MSMEs) registration provides several benefits to businesses, promoting their growth and development. MSME registration typically offers benefits and assistance to small and medium-sized businesses. These advantages could include easier access to credit, subsidies, and a variety of government programmes aimed at encouraging the growth of micro, small, and medium-sized businesses. Here are some of the main advantages:

✑ Access to Credit Facilities: MSME registration enables businesses to obtain credit from banks and financial institutions. It improves their creditworthiness because registration is seen as a validation of the company’s legitimacy and potential for expansion.

✑ Priority Sector Lending: Many financial institutions set specific lending targets for the priority sector, which includes MSMEs. MSME registration helps businesses qualify for priority sector lending, which results in better loan terms and interest rates.

✑ Government Subsidies and Grants: MSMEs frequently qualify for a variety of government subsidies, grants, and schemes designed to promote their growth and sustainability. These may include financial assistance, technology upgrade support, and marketing assistance.

✑ Reduced Interest Rates: Some financial institutions reduce interest rates for MSMEs, recognising their importance in driving economic development. Banks can consider MSME registration when determining loan interest rates.

✑ Ease of Obtaining Licenses: MSME registration makes it easier to obtain the necessary licences and permits for business operations. It may also exempt businesses from certain regulatory requirements, making it easier to navigate legal procedures.

✑ Market Access: MSME registration grants access to a variety of market development programmes, exhibitions, and trade fairs. Furthermore, in certain government procurement processes, MSMEs are frequently given preference, increasing their chances of success in the public sector.

✑ Technology and Infrastructure Support: MSMEs may receive assistance with technology upgrades and infrastructure development through government initiatives and programmes. This assistance can improve MSMEs’ competitiveness in the market.

✑ Credit Guarantee Fund Scheme: MSMEs may benefit from the Credit Guarantee Fund Scheme, which offers collateral-free credit to eligible businesses. This scheme enables businesses to secure loans without the need for traditional collateral.

✑ Income Tax Exemptions: Some MSMEs may be eligible for income tax exemptions and other tax benefits, which provide relief on their taxable income.

✑ Improved Credibility: MSME registration enhances a company’s credibility and market recognition. It communicates to customers, suppliers, and other stakeholders that the company is legitimate and recognised, potentially leading to more business opportunities.

✑ Resolution of disputes: The Micro, Small, and Medium Enterprises Development (MSMED) Act establishes a mechanism for the timely resolution of disputes through conciliation and arbitration.

✑ Concession on Electricity Bills: MSMEs may be eligible for a reduction in electricity bills in certain states, promoting cost savings.

Minimum Documents Required for Udyam Aadhar Registration in Pune

Documents/information required for Udyam Registration or MSME Registration in Pune:

📋 Bank Account Details

📋 Aadhar Number

📋 PAN Card Information

📋 Name of the Property Owner

📋 Date of Commencement

📋 National Industrial Classification Code (NIC code)

📋 Category of applicant

📋 Number of people employed

📋 Information on key activity

Further it is advisable to consult or take assistance of an expert professionals like Anuvartana Services LLP for error less and smooth MSME Registration in Pune.

If you want to obtain MSME registration Certificate, Anuvartana Services LLP is best place for it.

For more information or assistance in getting MSME registration Certificate in Pune, you can connect our experience experts for a free consultation on 8975973470 or anuvartanaservices@gmail.com

Udyam Registration is not required to obtain, but it is advised because it offers registered businesses a number of advantages.

Udyam Registration is available to any business that satisfies the requirements of the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006, which defines what constitutes a micro, small, or medium enterprise.

No, there is no government fee or payment necessary to complete the Udyam Registration process.

Yes, using the Udyam Registration portal, a company can change or update the information on its Udyam Registration.

The Udyam Registration procedure is online and can be finished quickly. Following submission, an immediate registration number is generated, and the registration certificate can be downloaded from the portal.